Unfortunately discussions about tax and monetary policy often devolve into concepts like class warfare and laziness. But we should really step back and truly understand how money behaves regardless of the behavior, good or bad, of the people related to that money. Basically start looking at the physics of the money itself. By doing this we can better understand how to create policies that allow for the best economies. And a strong economy is important to everyone, workers and investors alike.

For example let’s look at what happens as dollars collect. Each dollar basically has gravity. As dollars collect they tug / pull on other dollars and as the clump together they attract even more dollars. This happens due to things like compound interest. It is counteracted by an evaporative force, fees and the costs of living. Sometimes the other forces are enough to make those clumps evaporate completely. But the surviving clumps will grow and over time even accelerate. For example at $1,000 you expect to pay bank fees and get a low interest rate. But as you get to $10,000 you expect to pay no fees and get more interest and at $100,000 even more interest. And at some point these clumps of dollars are piles large enough to find alternative investments that are even more lucrative.

It works in reverse as well. As piles of money get smaller, the dollars in those piles are effectively attracted to bigger piles more easily. So as small piles get smaller, it takes more work to keep money flowing in; while big piles will attract dollars more easily.

When these piles get very large at some point there are enough dollars together they pull money in faster than it can leave. They become a dollar “black hole”. Say there is a pile of $1 billion, making an average net return of 3% from all investments. In this case, simply spending less than $30 million means that pile continues to grow. This is important. As dollars collect in these monetary back holes they slow the movement of dollars powering the economy.

When looking at the gravity of money, the intent of the people around the money is not particularly relevant. It’s not about good or bad people. It’s also not about benefiting or punishing those people. But rather working with, and when necessary fighting gravity, to maintain a healthy economy. And a healthy economy is incredibly important to investors and workers alike.

A Madman has spoken ….

Look we are in a fight, but the enemy is not liberal Americans, nor is it conservative Americans it is not even China. The “enemy” is a disease that is transmitted by a virus. It is killing Americans and costing our economy dearly. If we can manage to get it under control we can re open businesses and schools. As we develop treatments and eventually a vaccine then we can start living more normal lives.

Look we are in a fight, but the enemy is not liberal Americans, nor is it conservative Americans it is not even China. The “enemy” is a disease that is transmitted by a virus. It is killing Americans and costing our economy dearly. If we can manage to get it under control we can re open businesses and schools. As we develop treatments and eventually a vaccine then we can start living more normal lives. I am angry, some of that anger is on me and most on our country and leadership. It is sickening that we have allowed our fellow Americans to be oppressed by police and other institutions! The fact that this happens because of race makes this worse, because how disturbingly obvious it has been.

I am angry, some of that anger is on me and most on our country and leadership. It is sickening that we have allowed our fellow Americans to be oppressed by police and other institutions! The fact that this happens because of race makes this worse, because how disturbingly obvious it has been.

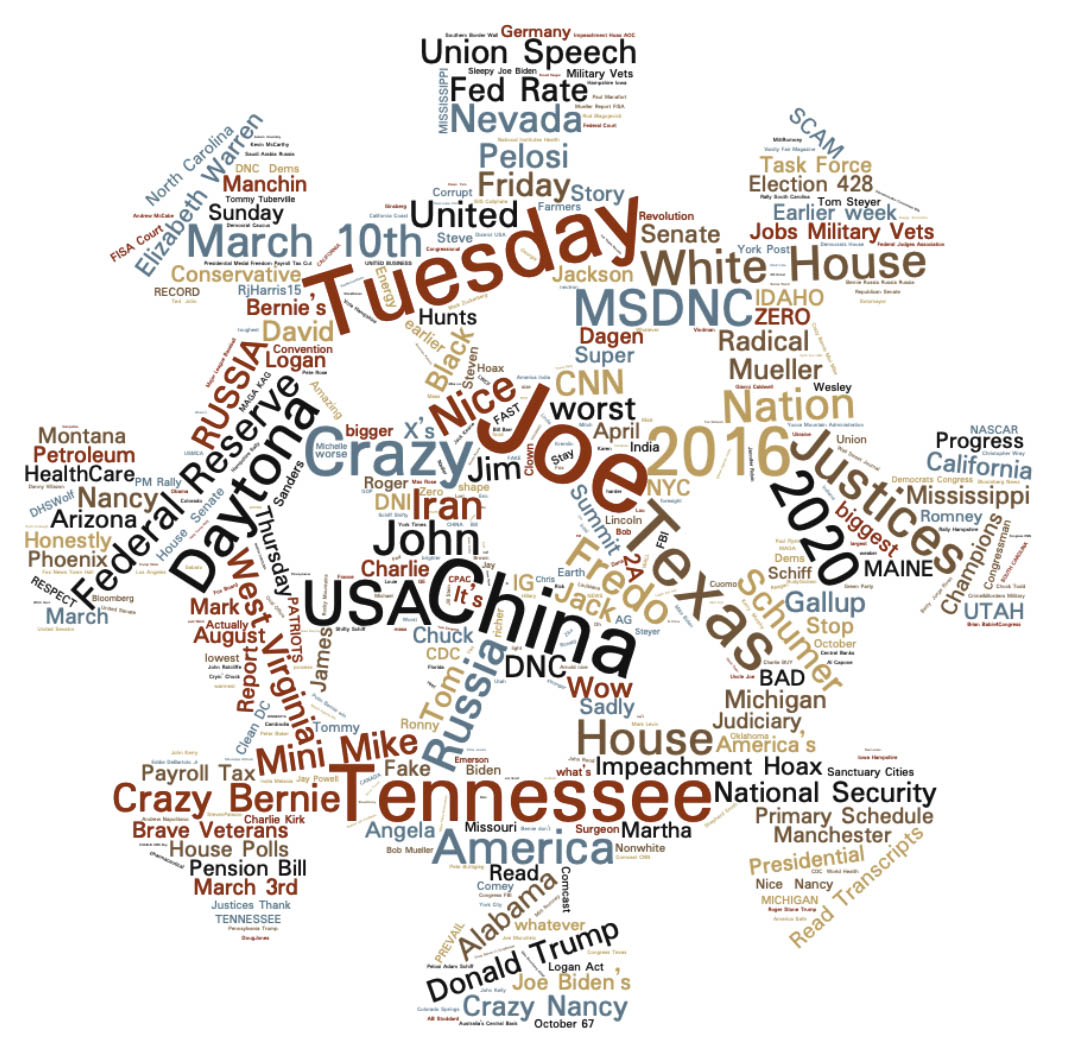

Ok there is a very good chance just reading the first three words in the title gave you a jolt of partisan fervor, at least it would me. Today we have a big problem where defining abuse of power is, why it’s important and even truth itself have been made to seem partisan. They are not and we need to wake up to the fact they are important to all Americans.

Ok there is a very good chance just reading the first three words in the title gave you a jolt of partisan fervor, at least it would me. Today we have a big problem where defining abuse of power is, why it’s important and even truth itself have been made to seem partisan. They are not and we need to wake up to the fact they are important to all Americans. California has passed law making it a requirement for primary candidates for governor or president of the USA must show their tax returns to the public to get on the state’s ballot. If you’re aware of the law it is highly likely you fit into one of three camps

California has passed law making it a requirement for primary candidates for governor or president of the USA must show their tax returns to the public to get on the state’s ballot. If you’re aware of the law it is highly likely you fit into one of three camps